Multi currency translation

When a company has foreign subsidiaries, a translation method is used to determine how the accounts of the subsidiary will

be tranferred to the consolidated accounts of the core company. Translation methods also determine the exchange rate that

applies to the transactions being transferred to the consolidated company's ledger accounts.

With the incipient move to IFRS, it's best to consider the consolidation process from the perspective of the account. Simply

put, translating an account (from a functional currency to a reporting currency) follows one of two methods:

1) Translate using the spot rate for the day of presentation (spot method)

2) Translate using the spot rate for the day of the transaction (historical method)

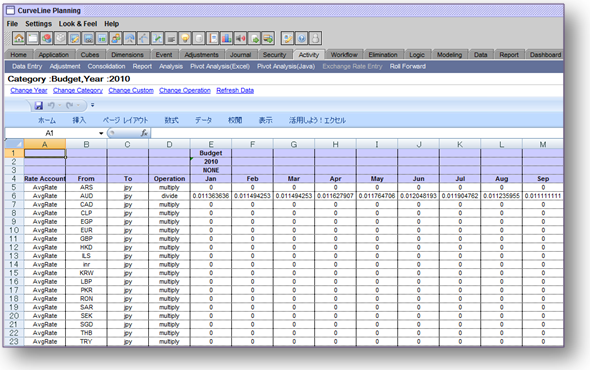

Curveline Management Solutions translates input data in local currency to a specified destination currency. The translation process will run

for the specified category year, period and rollup. Specific transaltion rules can be written to convert the accounts based on different rates

as per the requirements.

Curveline Management Solutions has the following translation features:

» Source data can be converted to multiple currencies

» Cross currency comparisons(for data owners and managers)easily enabled through real time translation

» Tranlsation rules can be written to accommodate varies user requirements

Click for price details

Click to contact for more details

Click for brochure

|